what does the term "indemnity" mean as it pertains to insurance?

In elementary terms, insurance is the act of indemnifying the hazard, acquired to another person. Conversely, reinsurance is when the insurance company takes up insurance to guard itself against the risk of loss. The two concepts are very similar to each other but may differ in they way; they are practical.

In elementary terms, insurance is the act of indemnifying the hazard, acquired to another person. Conversely, reinsurance is when the insurance company takes up insurance to guard itself against the risk of loss. The two concepts are very similar to each other but may differ in they way; they are practical.

Insurance is a very common form of financial protection which is used to provide protection against the take chances of losses. On the other hand, reinsurance is used by the insurance company, when it does not want to carry the entire risk, and shares the risk with another insurer. In reinsurance the run a risk of loss is underwritten past another company. This article excerpt explains the fundamental differences between insurance and reinsurance.

Content: Insurance Vs Reinsurance

- Comparison Chart

- Definition

- Key Differences

- Conclusion

Comparison Chart

| Basis for Comparison | Insurance | Reinsurance |

|---|---|---|

| Significant | Insurance alludes to a contract betwixt two parties wherein ane party promises to indemnify the other in example of loss or death. | Reinsurance ways insurance taken up by an insurance company when information technology does not wish to bear entire risk of loss and thus shares it with some other insurer. |

| Protection | Provided to individual or things. | Taken past the large insurance companies to survive large losses. |

| Premium | Paid by an private, is received by an insurance company. | Paid for reinsurance is divided among the insurance companies in specified ratio. |

Definition of Insurance

The term insurance is defined as a contract betwixt two parties insurer and insured, whereby the insurer agrees to indemnify certain losses caused to the insured, for adequate consideration, i.east. premium. The party who look for obtaining insurance policy is called insured, whereas the political party which assures the other to mitigate the run a risk is called insurer.

The agreement in which terms and conditions relating to insurance are specified is known as an insurance policy. It contains the details of losses covered by the policy and maximum corporeality to be paid in the event of death/loss.

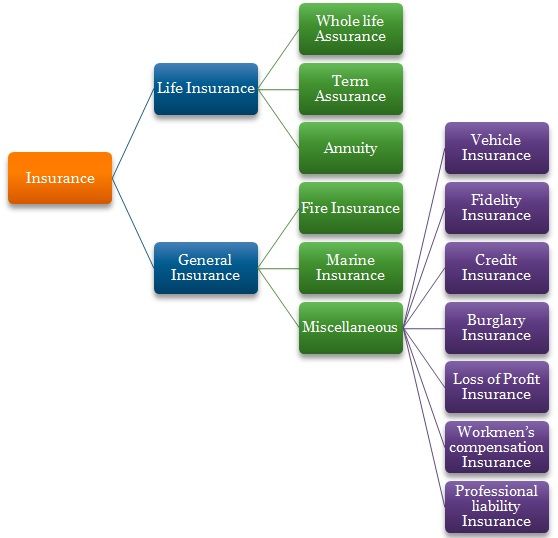

There are two types of insurance, i.due east. life insurance and general insurance:

- Life Insurance: The insurance which covers life run a risk of the insured, is life insurance or assurance. In the event of expiry, the amount is paid to the nominee.

- General Insurance: Whatsoever insurance other than the one which covers the risk of life is called general insurance. Information technology includes fire, marine, and other insurances.

Definition of Reinsurance

Reinsurance is used to mean an insurance contract between the ceding company and the reinsurer, whereby the two parties agrees to transfer and accept respectively, a definite proportion of take a chance or liability, equally defined in the agreement.

The original insurance visitor which agreed to indemnify the chance and likewise to 'cede' or transfer the risk/liability to some other insurance company is chosen ceding company. Moreover, the other insurance company is the reinsurer.

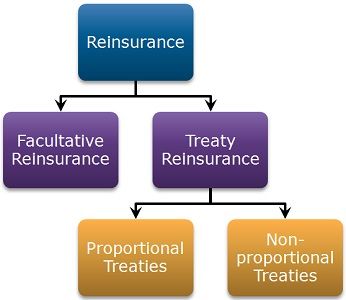

In full general insurance, some risks are so loftier, that it is not possible for one insurance company to behave solitary. In such a case the company insures the complete take a chance itself and pass on a specified portion of the risk to another insurance company and retains simply that amount of risk, which it tin behave. The premium received from the insured is shared by both the companies, in the agreed ratio. There are 2 types of reinsurance, given every bit follows:

- Facultative Reinsurance: A type of reinsurance contract, that covers the loss of a specific risk, which is expressed in the agreement.

- Treaty Reinsurance: In this contract, the 2 companies, i.e. the ceding company and the reinsurer enters into a treaty agreement, and the reinsurance is under the confines of the treaty. The limits may exist related to money, business, geography, etc.

Central Differences Between Insurance and Reinsurance

The points given below are noteworthy, so far every bit the difference between insurance and reinsurance is concerned:

- A contract between the insurer and insured wherein the former assures to indemnify the latter in the example of loss or death is known every bit insurance. Reinsurance refers to the insurance taken up by an insurance company to mitigate heavy losses when it does not wish to bear the unabridged risk of loss and thus shares it with some other insurer.

- In insurance, the protection is either provided to an private or things. On the other hand, in the example of reinsurance, the protection is taken by the large insurance companies to survive huge losses.

- In the case of insurance, the premium paid by the private is received by the insurance company only. Equally confronting this, in the case of reinsurance the premium paid by the insured, is shared by the insurance companies in a specified ratio.

Conclusion

Insurance and reinsurance contracts really help the insured, to recover losses. With the assist of reinsurance, the insurance company is able to pool the policies and divide the run a risk, among various firms, that ultimately saves the original insurance visitor from heavy losses.

Source: https://keydifferences.com/difference-between-insurance-and-reinsurance.html

0 Response to "what does the term "indemnity" mean as it pertains to insurance?"

Post a Comment